Recent General Posts

Real Value Packaged in Green: SERVPRO of Universal City/St. Hedwig can help

5/29/2021 (Permalink)

Real Value Packaged in Green: SERVPRO of Universal City/St. Hedwig can help

SERVPRO® of Universal City/St. Hedwig Professionals Provide Consistent Service and Reliable Information.

Whether you operate a single facility or hundreds of commercial properties nationwide, a fire or water damage requires prompt action to reduce losses and costly down time; who can you trust to provide dependable services and information?

SERVPRO® of Universal City/St. Hedwig Professionals respond quickly, providing a full line of cleaning and mitigation services to help ensure faster recovery. SERVPRO® of Universal City/St. Hedwig Professionals utilize technology designed specifically to provide you and your insurance company with quick, dependable information necessary to make more informed decisions faster, saving both time and money.

- Over 1,900 Franchises Nationwide

- Serving America Since 1967

- Trusted by Hundreds of Insurance Companies

- Nationwide Large Loss Response Team

- 24-Hour Emergency Response

Services Provided:

Restoration:

- Fire, Smoke and Soot

- Water Removal and Dehumidification

- Mold Mitigation and Remediation

- Catastrophic Storm Response

- Move Outs and Contents Restoration

- Document Drying

- Contents Claim Inventory Service

Cleaning:

- Air Ducts and HVAC

- Biohazard, Crime Scene and Vandalism

- Ceilings, Walls and Hard Floors

- Odor Identification

- Deodorization

SERVPRO of Universal City/St. Hedwig is dedicated to helping our residential and commercial neighbors in the San Antonio community if they are in need of the above services. We provide twenty-four-hour response seven days a week all year-round including holidays. Call SERVPRO today at (210) 610-6800.

Real Value Packaged in Green: SERVPRO of Universal City/St. Hedwig can help

5/29/2021 (Permalink)

Real Value Packaged in Green: SERVPRO of Universal City/St. Hedwig can help

SERVPRO® of Universal City/St. Hedwig Professionals Provide Consistent Service and Reliable Information.

Whether you operate a single facility or hundreds of commercial properties nationwide, a fire or water damage requires prompt action to reduce losses and costly down time; who can you trust to provide dependable services and information?

SERVPRO® of Universal City/St. Hedwig Professionals respond quickly, providing a full line of cleaning and mitigation services to help ensure faster recovery. SERVPRO® of Universal City/St. Hedwig Professionals utilize technology designed specifically to provide you and your insurance company with quick, dependable information necessary to make more informed decisions faster, saving both time and money.

- Over 1,900 Franchises Nationwide

- Serving America Since 1967

- Trusted by Hundreds of Insurance Companies

- Nationwide Large Loss Response Team

- 24-Hour Emergency Response

Services Provided:

Restoration:

- Fire, Smoke and Soot

- Water Removal and Dehumidification

- Mold Mitigation and Remediation

- Catastrophic Storm Response

- Move Outs and Contents Restoration

- Document Drying

- Contents Claim Inventory Service

Cleaning:

- Air Ducts and HVAC

- Biohazard, Crime Scene and Vandalism

- Ceilings, Walls and Hard Floors

- Odor Identification

- Deodorization

SERVPRO of Universal City/St. Hedwig is dedicated to helping our residential and commercial neighbors in the San Antonio community if they are in need of the above services. We provide twenty-four-hour response seven days a week all year-round including holidays. Call SERVPRO today at (210) 610-6800.

Real Value Packaged in Green: SERVPRO of Universal City/St. Hedwig can help

5/29/2021 (Permalink)

Real Value Packaged in Green: SERVPRO of Universal City/St. Hedwig can help

SERVPRO® of Universal City/St. Hedwig Professionals Provide Consistent Service and Reliable Information.

Whether you operate a single facility or hundreds of commercial properties nationwide, a fire or water damage requires prompt action to reduce losses and costly down time; who can you trust to provide dependable services and information?

SERVPRO® of Universal City/St. Hedwig Professionals respond quickly, providing a full line of cleaning and mitigation services to help ensure faster recovery. SERVPRO® of Universal City/St. Hedwig Professionals utilize technology designed specifically to provide you and your insurance company with quick, dependable information necessary to make more informed decisions faster, saving both time and money.

- Over 1,900 Franchises Nationwide

- Serving America Since 1967

- Trusted by Hundreds of Insurance Companies

- Nationwide Large Loss Response Team

- 24-Hour Emergency Response

Services Provided:

Restoration:

- Fire, Smoke and Soot

- Water Removal and Dehumidification

- Mold Mitigation and Remediation

- Catastrophic Storm Response

- Move Outs and Contents Restoration

- Document Drying

- Contents Claim Inventory Service

Cleaning:

- Air Ducts and HVAC

- Biohazard, Crime Scene and Vandalism

- Ceilings, Walls and Hard Floors

- Odor Identification

- Deodorization

SERVPRO of Universal City/St. Hedwig is dedicated to helping our residential and commercial neighbors in the San Antonio community if they are in need of the above services. We provide twenty-four-hour response seven days a week all year-round including holidays. Call SERVPRO today at (210) 610-6800.

Carpets and Upholstery Cleaning

3/22/2021 (Permalink)

Carpets and Upholstery Cleaning

Does your San Antonio carpet need cleaning? Even the highest-quality carpet and upholstery can show soiling over time. Protect your investment by calling us to clean and maintain your carpet and upholstery. The SERVPRO System offers a number of cleaning options to match any type of upholstery or carpet. SERVPRO of Universal City/ St. Hedwig is able to clean your upholstery after a water damage or fire damage to help get it back to pre loss conditions. SERVPRO of Universal City/ St. Hedwig also offers carpet cleaning that is associated with a water or fire damage event to your Converse residence or business.

Need Carpet or Upholstery Cleaning?

Call Today – (210) 610-6800

We also offer a range of specialized cleaning methods:

- Bonnet Cleaning: A less aggressive method for short pile carpets.

- Hot Water Extraction: A deeper cleaning method for all carpet types.

- Deluxe Precondition and Rinse: Helps restore deeply soiled areas.

- Showcase Premier Cleaning: The most thorough cleaning method in the industry.

- Dry Cleaning: When color-fastness is an issue.

Preventative Maintenance

Carpets act as a filter, trapping dust, dirt, gases, animal hair, and other soils. All carpet manufacturers agree on actions you can take between carpet cleanings to increase the lifespan of your carpet.

IICRC states that 79% of soil in carpet is dry soil. Vacuuming is a key component to proper care and maintenance of carpet.

Preventative maintenance actions include:

- Regular vacuuming

- Spot removal

- Piloting the carpet to prevent matting

- Moving furniture to change traffic patterns

- Using walk-off mats to limit the amount of soil tracked onto the carpet

Professional Cleaning

Our professional cleaning can address moderate and heavy soil conditions in your carpets. How often you’ll need professional cleaning depends on soil build-up, traffic, type and color of carpeting. A good rule of thumb would be to professionally clean your carpet every 12 months. The best advice is to clean carpets before they become totally saturated with soil. If you wait until carpets look really dirty, the carpets may never be restored to their former appearance. Dirt builds up in layers, and when a carpet looks dirty you are only seeing the dirt at the tips of the fibers. More dirt is hiding below the surface down near the base of the pile, causing damage to the carpet. When a carpet is saturated with dirt, the soil has penetrated crevices and has become firmly lodged.

We will get the job done right. For a cleaning backed by state-of-the-art equipment, over 40 years of experience and Professionals trained to the highest standards, call us today.

Carpets and Upholstery Cleaning

3/22/2021 (Permalink)

Carpets and Upholstery Cleaning

Does your San Antonio carpet need cleaning? Even the highest-quality carpet and upholstery can show soiling over time. Protect your investment by calling us to clean and maintain your carpet and upholstery. The SERVPRO System offers a number of cleaning options to match any type of upholstery or carpet. SERVPRO of Universal City/ St. Hedwig is able to clean your upholstery after a water damage or fire damage to help get it back to pre loss conditions. SERVPRO of Universal City/ St. Hedwig also offers carpet cleaning that is associated with a water or fire damage event to your Converse residence or business.

Need Carpet or Upholstery Cleaning?

Call Today – (210) 610-6800

We also offer a range of specialized cleaning methods:

- Bonnet Cleaning: A less aggressive method for short pile carpets.

- Hot Water Extraction: A deeper cleaning method for all carpet types.

- Deluxe Precondition and Rinse: Helps restore deeply soiled areas.

- Showcase Premier Cleaning: The most thorough cleaning method in the industry.

- Dry Cleaning: When color-fastness is an issue.

Preventative Maintenance

Carpets act as a filter, trapping dust, dirt, gases, animal hair, and other soils. All carpet manufacturers agree on actions you can take between carpet cleanings to increase the lifespan of your carpet.

IICRC states that 79% of soil in carpet is dry soil. Vacuuming is a key component to proper care and maintenance of carpet.

Preventative maintenance actions include:

- Regular vacuuming

- Spot removal

- Piloting the carpet to prevent matting

- Moving furniture to change traffic patterns

- Using walk-off mats to limit the amount of soil tracked onto the carpet

Professional Cleaning

Our professional cleaning can address moderate and heavy soil conditions in your carpets. How often you’ll need professional cleaning depends on soil build-up, traffic, type and color of carpeting. A good rule of thumb would be to professionally clean your carpet every 12 months. The best advice is to clean carpets before they become totally saturated with soil. If you wait until carpets look really dirty, the carpets may never be restored to their former appearance. Dirt builds up in layers, and when a carpet looks dirty you are only seeing the dirt at the tips of the fibers. More dirt is hiding below the surface down near the base of the pile, causing damage to the carpet. When a carpet is saturated with dirt, the soil has penetrated crevices and has become firmly lodged.

We will get the job done right. For a cleaning backed by state-of-the-art equipment, over 40 years of experience and Professionals trained to the highest standards, call us today.

Carpets and Upholstery Cleaning

3/22/2021 (Permalink)

Carpets and Upholstery Cleaning

Does your San Antonio carpet need cleaning? Even the highest-quality carpet and upholstery can show soiling over time. Protect your investment by calling us to clean and maintain your carpet and upholstery. The SERVPRO System offers a number of cleaning options to match any type of upholstery or carpet. SERVPRO of Universal City/ St. Hedwig is able to clean your upholstery after a water damage or fire damage to help get it back to pre loss conditions. SERVPRO of Universal City/ St. Hedwig also offers carpet cleaning that is associated with a water or fire damage event to your Converse residence or business.

Need Carpet or Upholstery Cleaning?

Call Today – (210) 610-6800

We also offer a range of specialized cleaning methods:

- Bonnet Cleaning: A less aggressive method for short pile carpets.

- Hot Water Extraction: A deeper cleaning method for all carpet types.

- Deluxe Precondition and Rinse: Helps restore deeply soiled areas.

- Showcase Premier Cleaning: The most thorough cleaning method in the industry.

- Dry Cleaning: When color-fastness is an issue.

Preventative Maintenance

Carpets act as a filter, trapping dust, dirt, gases, animal hair, and other soils. All carpet manufacturers agree on actions you can take between carpet cleanings to increase the lifespan of your carpet.

IICRC states that 79% of soil in carpet is dry soil. Vacuuming is a key component to proper care and maintenance of carpet.

Preventative maintenance actions include:

- Regular vacuuming

- Spot removal

- Piloting the carpet to prevent matting

- Moving furniture to change traffic patterns

- Using walk-off mats to limit the amount of soil tracked onto the carpet

Professional Cleaning

Our professional cleaning can address moderate and heavy soil conditions in your carpets. How often you’ll need professional cleaning depends on soil build-up, traffic, type and color of carpeting. A good rule of thumb would be to professionally clean your carpet every 12 months. The best advice is to clean carpets before they become totally saturated with soil. If you wait until carpets look really dirty, the carpets may never be restored to their former appearance. Dirt builds up in layers, and when a carpet looks dirty you are only seeing the dirt at the tips of the fibers. More dirt is hiding below the surface down near the base of the pile, causing damage to the carpet. When a carpet is saturated with dirt, the soil has penetrated crevices and has become firmly lodged.

We will get the job done right. For a cleaning backed by state-of-the-art equipment, over 40 years of experience and Professionals trained to the highest standards, call us today.

Odor Removal and Deodorization

3/18/2021 (Permalink)

Odor Removal and Deodorization

As experts in deodorization, SERVPRO of Universal City/St. Hedwig is trained to identify and eliminate offensive odors. These odors can come from a number of sources both inside and outside a structure.

SERVPRO teaches IICRC technical classes in the proper removal of odors. Masking and other shortcuts don't work when your odor problem is serious or persistent.

We have the training and equipment to identify and eliminate these offensive odors. By identifying the cause of the odor, and determining the conditions where it contacts surfaces, the odor can often be removed over time without a trace. Our technicians have access to several odor removal products capable of penetrating surfaces to neutralize an unpleasant odor thoroughly.

The science of identifying and eliminating odors can be a tricky thing, so give us a call, and leave the restoration to us.

SERVPRO of Universal City/St. Hedwig (210) 610-6800.

Odor Removal and Deodorization

3/18/2021 (Permalink)

Odor Removal and Deodorization

As experts in deodorization, SERVPRO of Universal City/St. Hedwig is trained to identify and eliminate offensive odors. These odors can come from a number of sources both inside and outside a structure.

SERVPRO teaches IICRC technical classes in the proper removal of odors. Masking and other shortcuts don't work when your odor problem is serious or persistent.

We have the training and equipment to identify and eliminate these offensive odors. By identifying the cause of the odor, and determining the conditions where it contacts surfaces, the odor can often be removed over time without a trace. Our technicians have access to several odor removal products capable of penetrating surfaces to neutralize an unpleasant odor thoroughly.

The science of identifying and eliminating odors can be a tricky thing, so give us a call, and leave the restoration to us.

SERVPRO of Universal City/St. Hedwig (210) 610-6800.

Odor Removal and Deodorization

3/18/2021 (Permalink)

Odor Removal and Deodorization

As experts in deodorization, SERVPRO of Universal City/St. Hedwig is trained to identify and eliminate offensive odors. These odors can come from a number of sources both inside and outside a structure.

SERVPRO teaches IICRC technical classes in the proper removal of odors. Masking and other shortcuts don't work when your odor problem is serious or persistent.

We have the training and equipment to identify and eliminate these offensive odors. By identifying the cause of the odor, and determining the conditions where it contacts surfaces, the odor can often be removed over time without a trace. Our technicians have access to several odor removal products capable of penetrating surfaces to neutralize an unpleasant odor thoroughly.

The science of identifying and eliminating odors can be a tricky thing, so give us a call, and leave the restoration to us.

SERVPRO of Universal City/St. Hedwig (210) 610-6800.

How Clean are Your Air Ducts?

1/28/2021 (Permalink)

How Clean are Your Air Ducts?

1/28/2021

Your air ducts, you don’t see them, so they must be just fine. But they do see a lot of traffic, but do they need to be cleaned?

Your air ducts do need cleaned if you have these issues;

- Permanent or long-term water damage.

- Mold, mildew, or other microbial growth.

- Debris buildup that restricts air-flow.

- Dust, cobwebs, or other debris visibly blowing from ductwork/registers.

- Evidence of insect or rodent infestation.

- Offensive odors from your duct work.

- Frequent bouts of illness or allergies among your family A SERVPRO of Universal City / St. Hedwig technician will inspect each air duct, opening all access panels. We will clean supply ducts, return ducts, air vents, and diffusers. In all cases of duct cleaning, it is also necessary to address the source of the dirty air duct to prevent recurrence, including moisture, water, dust, debris, pest contamination, and other pollutants.

- Want to reduce the need for duct cleaning?

- During normal operation, dust can accumulate in duct work that can lead to microbial growth. Duct cleaning will reduce this growth, as well as increase the efficiency of your system.

- Regularly change your air filter.

- Regularly schedule annual professional maintenance and cleaning.

- Maintain good housekeeping practices to reduce the likelihood of contaminants.

- Ensure air intakes are properly located.

- Have your duct work regularly inspected.

How Clean are Your Air Ducts?

1/28/2021 (Permalink)

How Clean are Your Air Ducts?

1/28/2021

Your air ducts, you don’t see them, so they must be just fine. But they do see a lot of traffic, but do they need to be cleaned?

Your air ducts do need cleaned if you have these issues;

- Permanent or long-term water damage.

- Mold, mildew, or other microbial growth.

- Debris buildup that restricts air-flow.

- Dust, cobwebs, or other debris visibly blowing from ductwork/registers.

- Evidence of insect or rodent infestation.

- Offensive odors from your duct work.

- Frequent bouts of illness or allergies among your family A SERVPRO of Universal City / St. Hedwig technician will inspect each air duct, opening all access panels. We will clean supply ducts, return ducts, air vents, and diffusers. In all cases of duct cleaning, it is also necessary to address the source of the dirty air duct to prevent recurrence, including moisture, water, dust, debris, pest contamination, and other pollutants.

- Want to reduce the need for duct cleaning?

- During normal operation, dust can accumulate in duct work that can lead to microbial growth. Duct cleaning will reduce this growth, as well as increase the efficiency of your system.

- Regularly change your air filter.

- Regularly schedule annual professional maintenance and cleaning.

- Maintain good housekeeping practices to reduce the likelihood of contaminants.

- Ensure air intakes are properly located.

- Have your duct work regularly inspected.

How Clean are Your Air Ducts?

1/28/2021 (Permalink)

How Clean are Your Air Ducts?

1/28/2021

Your air ducts, you don’t see them, so they must be just fine. But they do see a lot of traffic, but do they need to be cleaned?

Your air ducts do need cleaned if you have these issues;

- Permanent or long-term water damage.

- Mold, mildew, or other microbial growth.

- Debris buildup that restricts air-flow.

- Dust, cobwebs, or other debris visibly blowing from ductwork/registers.

- Evidence of insect or rodent infestation.

- Offensive odors from your duct work.

- Frequent bouts of illness or allergies among your family A SERVPRO of Universal City / St. Hedwig technician will inspect each air duct, opening all access panels. We will clean supply ducts, return ducts, air vents, and diffusers. In all cases of duct cleaning, it is also necessary to address the source of the dirty air duct to prevent recurrence, including moisture, water, dust, debris, pest contamination, and other pollutants.

- Want to reduce the need for duct cleaning?

- During normal operation, dust can accumulate in duct work that can lead to microbial growth. Duct cleaning will reduce this growth, as well as increase the efficiency of your system.

- Regularly change your air filter.

- Regularly schedule annual professional maintenance and cleaning.

- Maintain good housekeeping practices to reduce the likelihood of contaminants.

- Ensure air intakes are properly located.

- Have your duct work regularly inspected.

SERVPRO handles your insurance company

3/9/2020 (Permalink)

For people in San Antonio, one of the top full-service property damage restoration companies is SERVPRO. We help people in the San Antonio area recover from damage to their residential or commercial property such as fire damage, flood damage, sewage backup, and infestations of mold. We are a locally owned and managed franchise that also has access to the resources of a national brand.

The team at SERVPRO works directly with insurance companies in the event of a claim. This reduces the work that a homeowner or commercial property owner has to devote to getting their claim resolved. It also helps speed up the process which reduces the cost of the claim and mitigates the damage that occurs to the property. By having this company work directly with the insurance company the homeowner or business can get back to using their property as soon as possible.

Whether it is a small insurance claim or a large one the team at SERVPRO can assess the damage, get it cleaned up, and get the property restored to the condition it was in before the damage occurred. The employees are trained to resolve property damage at both the regional level and at this company's national training facility. We receive ongoing training in order to stay on top of the latest techniques to restore property. This company also offers educational classes to insurance adjusters, insurance agents, and other professionals who work with real estate.

SERVPRO handles your insurance company

3/9/2020 (Permalink)

For people in San Antonio, one of the top full-service property damage restoration companies is SERVPRO. We help people in the San Antonio area recover from damage to their residential or commercial property such as fire damage, flood damage, sewage backup, and infestations of mold. We are a locally owned and managed franchise that also has access to the resources of a national brand.

The team at SERVPRO works directly with insurance companies in the event of a claim. This reduces the work that a homeowner or commercial property owner has to devote to getting their claim resolved. It also helps speed up the process which reduces the cost of the claim and mitigates the damage that occurs to the property. By having this company work directly with the insurance company the homeowner or business can get back to using their property as soon as possible.

Whether it is a small insurance claim or a large one the team at SERVPRO can assess the damage, get it cleaned up, and get the property restored to the condition it was in before the damage occurred. The employees are trained to resolve property damage at both the regional level and at this company's national training facility. We receive ongoing training in order to stay on top of the latest techniques to restore property. This company also offers educational classes to insurance adjusters, insurance agents, and other professionals who work with real estate.

SERVPRO handles your insurance company

3/9/2020 (Permalink)

For people in San Antonio, one of the top full-service property damage restoration companies is SERVPRO. We help people in the San Antonio area recover from damage to their residential or commercial property such as fire damage, flood damage, sewage backup, and infestations of mold. We are a locally owned and managed franchise that also has access to the resources of a national brand.

The team at SERVPRO works directly with insurance companies in the event of a claim. This reduces the work that a homeowner or commercial property owner has to devote to getting their claim resolved. It also helps speed up the process which reduces the cost of the claim and mitigates the damage that occurs to the property. By having this company work directly with the insurance company the homeowner or business can get back to using their property as soon as possible.

Whether it is a small insurance claim or a large one the team at SERVPRO can assess the damage, get it cleaned up, and get the property restored to the condition it was in before the damage occurred. The employees are trained to resolve property damage at both the regional level and at this company's national training facility. We receive ongoing training in order to stay on top of the latest techniques to restore property. This company also offers educational classes to insurance adjusters, insurance agents, and other professionals who work with real estate.

SERVPRO of Universal City / St. Hedwig!

1/7/2020 (Permalink)

SERVPRO of Universal City / St. Hedwig provides 24-hour emergency service and is dedicated to being faster to any-sized disaster in Bexar County. We can respond immediately to your emergency and have the expertise to handle your restoration or cleaning needs.

- 24-Hour Emergency Service

- Faster to Any-Sized Disaster

- Highly Trained Restoration Technicians

- A Trusted Leader in the Restoration Industry

- Locally Owned and Operated

- Advanced Restoration and Cleaning Equipment

Have Questions? Call Us 24/7 – (210) 610-6800

Residential Services

Whether your Bexar County home needs emergency flood damage or your upholstery cleaned, you can depend on us. Our technicians have extensive cleaning and restoration training and can make your property look its best. Learn more about our residential services:

- Water Damage Restoration

- Fire Damage Restoration

- Mold Remediation

- Storm Damage Restoration

- Cleaning Services

- Building/Reconstruction Services

Commercial Services

There's never a convenient time for fire or Water damage to strike your Bexar County commercial property. Every hour spent cleaning up is an hour of lost revenue and productivity. So, when the need arises for professional cleaning or emergency restoration services, we have the training and expertise to respond promptly with highly trained technicians to get your property back to business.

- Commercial Water Damage Restoration

- Commercial Fire Damage Restoration

SERVPRO of Universal City / St. Hedwig!

1/7/2020 (Permalink)

SERVPRO of Universal City / St. Hedwig provides 24-hour emergency service and is dedicated to being faster to any-sized disaster in Bexar County. We can respond immediately to your emergency and have the expertise to handle your restoration or cleaning needs.

- 24-Hour Emergency Service

- Faster to Any-Sized Disaster

- Highly Trained Restoration Technicians

- A Trusted Leader in the Restoration Industry

- Locally Owned and Operated

- Advanced Restoration and Cleaning Equipment

Have Questions? Call Us 24/7 – (210) 610-6800

Residential Services

Whether your Bexar County home needs emergency flood damage or your upholstery cleaned, you can depend on us. Our technicians have extensive cleaning and restoration training and can make your property look its best. Learn more about our residential services:

- Water Damage Restoration

- Fire Damage Restoration

- Mold Remediation

- Storm Damage Restoration

- Cleaning Services

- Building/Reconstruction Services

Commercial Services

There's never a convenient time for fire or Water damage to strike your Bexar County commercial property. Every hour spent cleaning up is an hour of lost revenue and productivity. So, when the need arises for professional cleaning or emergency restoration services, we have the training and expertise to respond promptly with highly trained technicians to get your property back to business.

- Commercial Water Damage Restoration

- Commercial Fire Damage Restoration

SERVPRO of Universal City / St. Hedwig!

1/7/2020 (Permalink)

SERVPRO of Universal City / St. Hedwig provides 24-hour emergency service and is dedicated to being faster to any-sized disaster in Bexar County. We can respond immediately to your emergency and have the expertise to handle your restoration or cleaning needs.

- 24-Hour Emergency Service

- Faster to Any-Sized Disaster

- Highly Trained Restoration Technicians

- A Trusted Leader in the Restoration Industry

- Locally Owned and Operated

- Advanced Restoration and Cleaning Equipment

Have Questions? Call Us 24/7 – (210) 610-6800

Residential Services

Whether your Bexar County home needs emergency flood damage or your upholstery cleaned, you can depend on us. Our technicians have extensive cleaning and restoration training and can make your property look its best. Learn more about our residential services:

- Water Damage Restoration

- Fire Damage Restoration

- Mold Remediation

- Storm Damage Restoration

- Cleaning Services

- Building/Reconstruction Services

Commercial Services

There's never a convenient time for fire or Water damage to strike your Bexar County commercial property. Every hour spent cleaning up is an hour of lost revenue and productivity. So, when the need arises for professional cleaning or emergency restoration services, we have the training and expertise to respond promptly with highly trained technicians to get your property back to business.

- Commercial Water Damage Restoration

- Commercial Fire Damage Restoration

SERVPRO Is Ready To Work!

4/1/2019 (Permalink)

Here at SERVPRO of Universal City / St. Hedwig, we make sure to always take care of your needs. Our trained professionals are able to talk you through every step throughout our restoration process. It does not matter what situation you are in, whether it be a fire damage, water damage, general cleaning, or reconstruction, we ca handle it!

At SERVPRO of Universal City / St. Hedwig, we are the most trusted franchises in the city of San Antonio, and have experience in every service that we offer. It is important that you know that we do not only offer our flagship services such as fire and water damage cleanup. We also offer biohazard and crime scene cleanup. That's right! After our great first responders wrap up their things, we are next in line to restore your home!

If you ever find yourself in any unfortunate situation, do not hesitate to call us at any time. We are available 24 hours, and are ready to work when you call!

SERVPRO Is Ready To Work!

4/1/2019 (Permalink)

Here at SERVPRO of Universal City / St. Hedwig, we make sure to always take care of your needs. Our trained professionals are able to talk you through every step throughout our restoration process. It does not matter what situation you are in, whether it be a fire damage, water damage, general cleaning, or reconstruction, we ca handle it!

At SERVPRO of Universal City / St. Hedwig, we are the most trusted franchises in the city of San Antonio, and have experience in every service that we offer. It is important that you know that we do not only offer our flagship services such as fire and water damage cleanup. We also offer biohazard and crime scene cleanup. That's right! After our great first responders wrap up their things, we are next in line to restore your home!

If you ever find yourself in any unfortunate situation, do not hesitate to call us at any time. We are available 24 hours, and are ready to work when you call!

SERVPRO Is Ready To Work!

4/1/2019 (Permalink)

Here at SERVPRO of Universal City / St. Hedwig, we make sure to always take care of your needs. Our trained professionals are able to talk you through every step throughout our restoration process. It does not matter what situation you are in, whether it be a fire damage, water damage, general cleaning, or reconstruction, we ca handle it!

At SERVPRO of Universal City / St. Hedwig, we are the most trusted franchises in the city of San Antonio, and have experience in every service that we offer. It is important that you know that we do not only offer our flagship services such as fire and water damage cleanup. We also offer biohazard and crime scene cleanup. That's right! After our great first responders wrap up their things, we are next in line to restore your home!

If you ever find yourself in any unfortunate situation, do not hesitate to call us at any time. We are available 24 hours, and are ready to work when you call!

SERVPRO- We Are Here To Help!

3/7/2019 (Permalink)

SERVPRO of Universal City / St. Hedwig, as you know, is a fire and water restoration company who also specializes in reconstruction as well cleanup in residential and commercial businesses. Here at SERVPRO of Universal City / St. Hedwig, we pride ourselves in making sure that whatever situation you are in, that it is taken care of immediately.

When it comes to us as a company, you do not have to worry about calling four or five different companies to take on multiple tasks for you. When you call us, that is the only call that you will have to make. Our production crew is well-trained, and is able to take on any challenge that is put in front of them. Next time, if you encounter a situation, do not hesitate to call us!

SERVPRO- We Are Here To Help!

3/7/2019 (Permalink)

SERVPRO of Universal City / St. Hedwig, as you know, is a fire and water restoration company who also specializes in reconstruction as well cleanup in residential and commercial businesses. Here at SERVPRO of Universal City / St. Hedwig, we pride ourselves in making sure that whatever situation you are in, that it is taken care of immediately.

When it comes to us as a company, you do not have to worry about calling four or five different companies to take on multiple tasks for you. When you call us, that is the only call that you will have to make. Our production crew is well-trained, and is able to take on any challenge that is put in front of them. Next time, if you encounter a situation, do not hesitate to call us!

SERVPRO- We Are Here To Help!

3/7/2019 (Permalink)

SERVPRO of Universal City / St. Hedwig, as you know, is a fire and water restoration company who also specializes in reconstruction as well cleanup in residential and commercial businesses. Here at SERVPRO of Universal City / St. Hedwig, we pride ourselves in making sure that whatever situation you are in, that it is taken care of immediately.

When it comes to us as a company, you do not have to worry about calling four or five different companies to take on multiple tasks for you. When you call us, that is the only call that you will have to make. Our production crew is well-trained, and is able to take on any challenge that is put in front of them. Next time, if you encounter a situation, do not hesitate to call us!

The SERVPRO of Universal City / St. Hedwig Experience

1/10/2019 (Permalink)

The SERVPRO of Universal City / St. Hedwig experience is something that is worth your while. Whenever you call SERVPRO of Universal City / St. Hedwig, this is what you can expect:

- Fast response. Technicians in uniform will arrive on-site usually within four hours of notification.

- Convenient Service. In Universal City / St. Hedwig, our services available in our territory.

- Damage Containment. Timely response can mean the difference between restoring property and replacing it.

- Nationally, SERVPRO has been a leading fire and water restoration provider for over 40 years.

- SERVPRO of Universal City / St. Hedwig has large loss capabilities and can handle any fire or water damage, no matter how big.

Whenever you call, SERVPRO of Universal City / St. Hedwig will make sure that we get to you location on time, and provide great service!

The SERVPRO of Universal City / St. Hedwig Experience

1/10/2019 (Permalink)

The SERVPRO of Universal City / St. Hedwig experience is something that is worth your while. Whenever you call SERVPRO of Universal City / St. Hedwig, this is what you can expect:

- Fast response. Technicians in uniform will arrive on-site usually within four hours of notification.

- Convenient Service. In Universal City / St. Hedwig, our services available in our territory.

- Damage Containment. Timely response can mean the difference between restoring property and replacing it.

- Nationally, SERVPRO has been a leading fire and water restoration provider for over 40 years.

- SERVPRO of Universal City / St. Hedwig has large loss capabilities and can handle any fire or water damage, no matter how big.

Whenever you call, SERVPRO of Universal City / St. Hedwig will make sure that we get to you location on time, and provide great service!

The SERVPRO of Universal City / St. Hedwig Experience

1/10/2019 (Permalink)

The SERVPRO of Universal City / St. Hedwig experience is something that is worth your while. Whenever you call SERVPRO of Universal City / St. Hedwig, this is what you can expect:

- Fast response. Technicians in uniform will arrive on-site usually within four hours of notification.

- Convenient Service. In Universal City / St. Hedwig, our services available in our territory.

- Damage Containment. Timely response can mean the difference between restoring property and replacing it.

- Nationally, SERVPRO has been a leading fire and water restoration provider for over 40 years.

- SERVPRO of Universal City / St. Hedwig has large loss capabilities and can handle any fire or water damage, no matter how big.

Whenever you call, SERVPRO of Universal City / St. Hedwig will make sure that we get to you location on time, and provide great service!

SERVPRO's Emergency Ready Profile

11/26/2018 (Permalink)

Don't you like being prepared for anything? With no worries?

SERVPRO of Universal City / St. Hedwig offers a free diagnosis of what steps take should an unfortunate event take place. Also known as ERPs, this feature consists of general information about your company such as address and zip code.

We also dig deeper into things such as how big your building is, is it commercial or residential, and how many stories your building is. We find ERPs useful because it helps us determine what needs to be done in order for your home or company can get back functioning the way that it should.

Here at SERVPRO of Universal City / St. Hedwig, we want you to be prepared as you can with an ERP.

SERVPRO's Emergency Ready Profile

11/26/2018 (Permalink)

Don't you like being prepared for anything? With no worries?

SERVPRO of Universal City / St. Hedwig offers a free diagnosis of what steps take should an unfortunate event take place. Also known as ERPs, this feature consists of general information about your company such as address and zip code.

We also dig deeper into things such as how big your building is, is it commercial or residential, and how many stories your building is. We find ERPs useful because it helps us determine what needs to be done in order for your home or company can get back functioning the way that it should.

Here at SERVPRO of Universal City / St. Hedwig, we want you to be prepared as you can with an ERP.

SERVPRO's Emergency Ready Profile

11/26/2018 (Permalink)

Don't you like being prepared for anything? With no worries?

SERVPRO of Universal City / St. Hedwig offers a free diagnosis of what steps take should an unfortunate event take place. Also known as ERPs, this feature consists of general information about your company such as address and zip code.

We also dig deeper into things such as how big your building is, is it commercial or residential, and how many stories your building is. We find ERPs useful because it helps us determine what needs to be done in order for your home or company can get back functioning the way that it should.

Here at SERVPRO of Universal City / St. Hedwig, we want you to be prepared as you can with an ERP.

Understanding Content Coverage

1/31/2018 (Permalink)

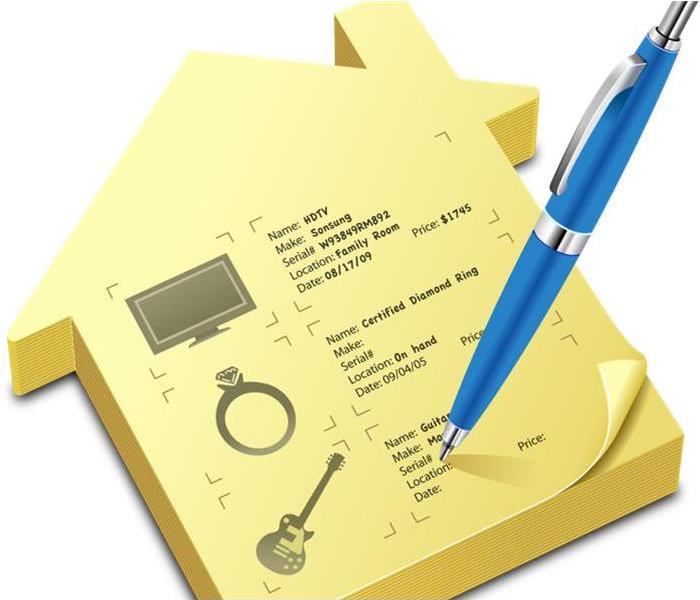

The best way to determine if you have enough content coverage is to conduct a home inventory.

The best way to determine if you have enough content coverage is to conduct a home inventory.

Everyone has homeowners insurance right? It’s one of those things you have and hope you never have to use right? So, what happens if you do have to utilize coverage because of a damage?

Unfortunately, because homeowners insurance is necessary many homeowners rely solely on their agents to choose a policy that is right for them. This is totally fine, and works in many cases, but being educated on what your policy includes and doesn’t include is important.

Most policies are written and cover to repair or rebuild your home after damage. But what about ALL of the personal belongings inside of your home? Generally, your content coverage is 50 to 70 percent of the coverage that you carry on the structure of your home. In most cases this is a sufficient amount to cover personal items that are damaged, but in some cases it isn’t.

The best way to determine if you have enough content coverage is to conduct a home inventory. This is a much easier task thanks to modern technology. Walk through your home room by room and photograph all personal belongings. (TIP-If you picked your home up and turned it upside down, all items that would fall out are considered contents.) Open drawers and closets to photograph all items inside. You can catalog these items and keep them at an offsite location or you can download an app such as DreamVault and access it from any mobile device. This particular app is designed to house photos and information pertaining to each individual item, such as price, model and serial number. There is also a speech to text feature to help with documentation.

If you have jewelry, collector’s items, art or firearms, sometimes your coverage can fall short. Keep that in mind when documenting all items and reviewing your policy. If you find that your coverage is lacking you can generally purchase additional coverage or a rider for certain items.

When you have had damage to your home and personal belongings, you don’t want to worry with the added stress of insufficient coverage. Ensure that you are covered.

If you have damage to your home and/or personal items we are here to help. Call our office and we will walk you through the process and make your damage “Like it never even happened.”

Understanding Content Coverage

1/31/2018 (Permalink)

The best way to determine if you have enough content coverage is to conduct a home inventory.

The best way to determine if you have enough content coverage is to conduct a home inventory.

Everyone has homeowners insurance right? It’s one of those things you have and hope you never have to use right? So, what happens if you do have to utilize coverage because of a damage?

Unfortunately, because homeowners insurance is necessary many homeowners rely solely on their agents to choose a policy that is right for them. This is totally fine, and works in many cases, but being educated on what your policy includes and doesn’t include is important.

Most policies are written and cover to repair or rebuild your home after damage. But what about ALL of the personal belongings inside of your home? Generally, your content coverage is 50 to 70 percent of the coverage that you carry on the structure of your home. In most cases this is a sufficient amount to cover personal items that are damaged, but in some cases it isn’t.

The best way to determine if you have enough content coverage is to conduct a home inventory. This is a much easier task thanks to modern technology. Walk through your home room by room and photograph all personal belongings. (TIP-If you picked your home up and turned it upside down, all items that would fall out are considered contents.) Open drawers and closets to photograph all items inside. You can catalog these items and keep them at an offsite location or you can download an app such as DreamVault and access it from any mobile device. This particular app is designed to house photos and information pertaining to each individual item, such as price, model and serial number. There is also a speech to text feature to help with documentation.

If you have jewelry, collector’s items, art or firearms, sometimes your coverage can fall short. Keep that in mind when documenting all items and reviewing your policy. If you find that your coverage is lacking you can generally purchase additional coverage or a rider for certain items.

When you have had damage to your home and personal belongings, you don’t want to worry with the added stress of insufficient coverage. Ensure that you are covered.

If you have damage to your home and/or personal items we are here to help. Call our office and we will walk you through the process and make your damage “Like it never even happened.”

Understanding Content Coverage

1/31/2018 (Permalink)

The best way to determine if you have enough content coverage is to conduct a home inventory.

The best way to determine if you have enough content coverage is to conduct a home inventory.

Everyone has homeowners insurance right? It’s one of those things you have and hope you never have to use right? So, what happens if you do have to utilize coverage because of a damage?

Unfortunately, because homeowners insurance is necessary many homeowners rely solely on their agents to choose a policy that is right for them. This is totally fine, and works in many cases, but being educated on what your policy includes and doesn’t include is important.

Most policies are written and cover to repair or rebuild your home after damage. But what about ALL of the personal belongings inside of your home? Generally, your content coverage is 50 to 70 percent of the coverage that you carry on the structure of your home. In most cases this is a sufficient amount to cover personal items that are damaged, but in some cases it isn’t.

The best way to determine if you have enough content coverage is to conduct a home inventory. This is a much easier task thanks to modern technology. Walk through your home room by room and photograph all personal belongings. (TIP-If you picked your home up and turned it upside down, all items that would fall out are considered contents.) Open drawers and closets to photograph all items inside. You can catalog these items and keep them at an offsite location or you can download an app such as DreamVault and access it from any mobile device. This particular app is designed to house photos and information pertaining to each individual item, such as price, model and serial number. There is also a speech to text feature to help with documentation.

If you have jewelry, collector’s items, art or firearms, sometimes your coverage can fall short. Keep that in mind when documenting all items and reviewing your policy. If you find that your coverage is lacking you can generally purchase additional coverage or a rider for certain items.

When you have had damage to your home and personal belongings, you don’t want to worry with the added stress of insufficient coverage. Ensure that you are covered.

If you have damage to your home and/or personal items we are here to help. Call our office and we will walk you through the process and make your damage “Like it never even happened.”

24/7 Emergency Service

24/7 Emergency Service